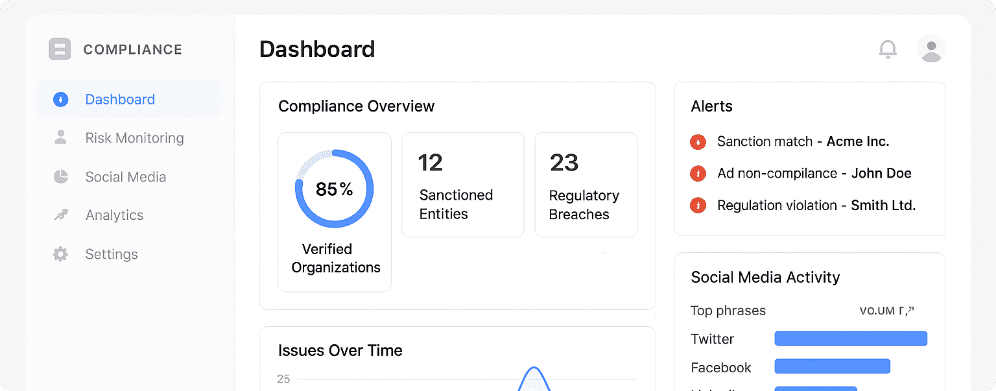

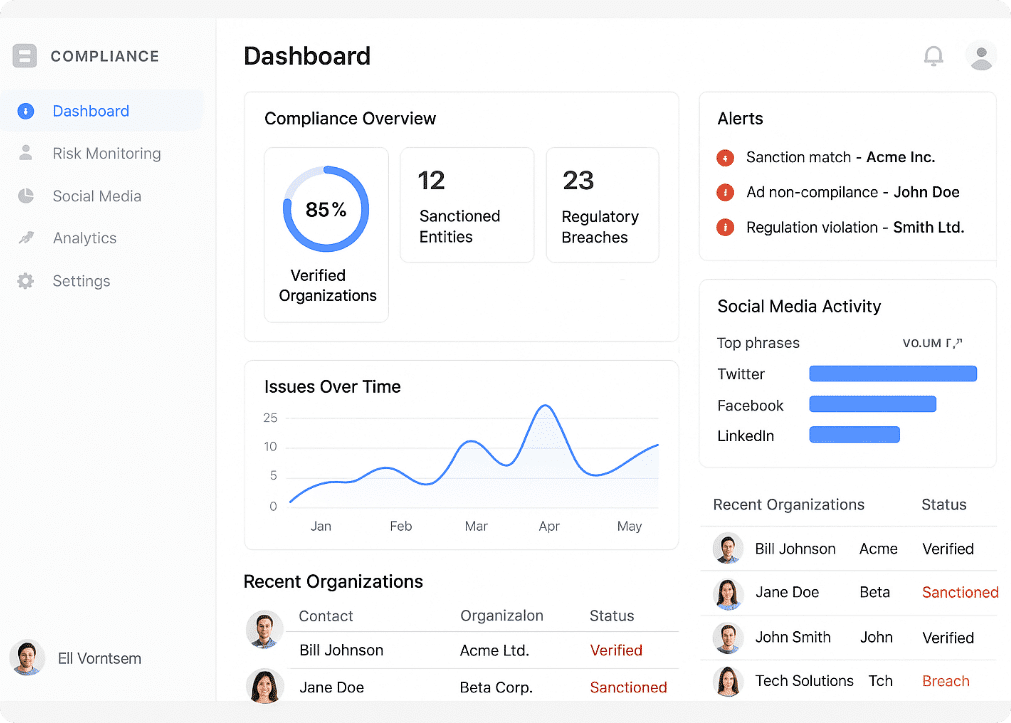

When you initiate a due diligence check, our advanced AI technology scans a wide range of information from around the world, including financial data and social media posts. This gives you confidence in the partners representing your brand. Real-time monitoring comes as standard, so any change in an organisation’s status triggers a proactive alert to help ensure ongoing compliance.

Building on the financial sector’s innovations in Know Your Customer (KYC) and Know Your Business (KYB), ICEF is pioneering the integration of these technological advancements into the international student recruitment industry, as part of our ongoing mission to raise standards.